This market research report was originally published at Tractica's website. It is reprinted here with the permission of Tractica.

Andrew Ng recently said that one lesson he learned in the early years of the internet is that traditional retailers adding a website does not equal an e-commerce company. Amazon, which built an internet business from the ground up and worked hard at optimizing and shaping supply chain processes toward digital and applying digital techniques like A/B testing, eventually became the flag bearer for e-commerce. Ng says that it took the industry many years before it really understood the fundamentals of what makes a successful internet business, and the lean methodologies that we now take for granted.

The same analogy can be applied to artificial intelligence (AI) today. We are at the very early stages of the AI revolution, but the problem is that we do not have a very good understanding of what those fundamental pillars might be for building successful AI businesses. We know that every industry vertical will see the impact of AI, and as a result, chief experience officers (CXOs) are trying to wrap their heads around what it really means to be an “AI first” business, and whether they can deliver on the AI promise. This gap in “promises versus capabilities” is very apparent in the automotive sector.

The Automotive Industry’s Next-Generation Focus and a Shift in Value

I recently attended the TU-Automotive Europe show in Munich, which was focused on the next generation of automotive technologies like mobility-as-a-service, self-driving cars, and connected cars. The contrast in vision and outlook was very apparent between Silicon Valley’s next-generation mobility companies and traditional auto original equipment manufacturers (OEMs). The traditional auto OEMs painted a much more cautious picture of how the industry will evolve, whether it is around self-driving or electric motors. This is not surprising after auto OEMs spent decades finessing the supply chain and assembly line, creating a robust and well-honed engineering workflow and organizational structure that works with clockwork precision. Most auto assembly lines are fully automated and use a high percentage of robots to squeeze out the maximum efficiency, simultaneously allowing drill-down customization and personalization, while adhering to safety and regulatory standards.

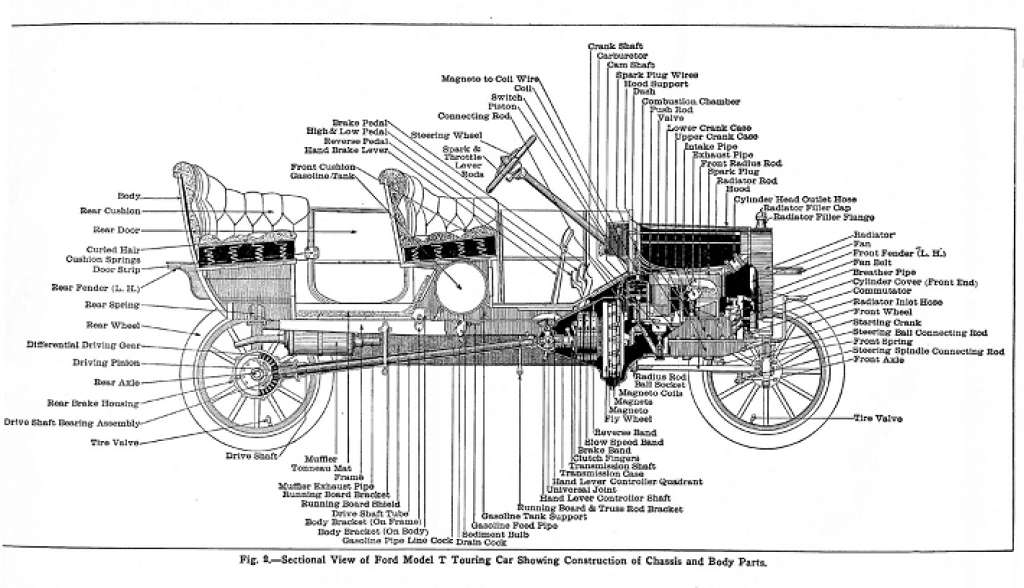

However, at the end of the day, auto OEMs and their wide network of component suppliers, which represents more than $700 billion in revenue annually, are in the business of manufacturing and selling cars, which are their end products. Although the services and post-sales infrastructure is massive, the car is the main product. As the car becomes electric and moves away from the internal combustion engine, the number of moving parts decreases from 10,000 to around 150. Add self-driving capabilities, which is driven by software, and the car essentially becomes a very different product than what was originally envisioned in the days of the Ford Model T. The next-generation car is essentially software on wheels, with fewer moving physical moving parts that need servicing, replacement, or integration. The car as a physical asset does not need to be parked in your garage, and can be shared across a fleet in your city or neighborhood. The value moves from the car itself to the experience that one creates across passenger journeys. The end customer is not the driver or the owner of the car who builds a relationship across many years, but the passenger who is likely to use the car momentarily for a specific journey ranging from a few minutes to maybe a few hours.

(Source: Pinterest)

Established auto OEMs are in for some major disruptions in terms of their business models, manufacturing infrastructure, supplier relationships, and dealer relationships, which are all likely to shift in the next 5, 10, or 20 years. While most auto OEMs can see this disruption on the horizon, few are expected to survive this major disruption. A recent note of caution from former General Motors executive Bob Lutz sounds like the “Burning Platform” equivalent for the auto industry. Bob does not mince words when he says, “The era of the human-driven automobile, its repair facilities, its dealerships, the media surrounding it — all will be gone in 20 years.”

Becoming an Automotive Company Requires New Ways of Thinking

At the heart of this disruption is going to be AI; whether it is self-driving cars, car safety, managing supply chains, personalized services within cars, or the rise of new ride sharing and mobility on-demand services. Auto OEMs are working on some or all these areas, and in the context of what Andrew Ng says, OEMs are trying to become automotive AI companies. Each OEM has a team of machine learning and deep learning engineers tasked to help them ride this wave of disruption. The problem arises when they start to implement strategies and launch services using AI. In many cases, traditional thinking is being applied to solving new problems.

One good example of this was BMW’s presentation at TU-Automotive Europe about BMW CarData. This is a new service that allows 8.5 million BMW ConnectedDrive customers to securely upload car data to third parties, which can then offer unique customized services based on the personal data. In other words, AI can be applied to consumer and car data in a privacy-controlled and secure manner. However, the problem lies in how this is being implemented and what that means from a customer experience perspective. Every time a third party wants to offer a service, it sends out a request to a customer, who must provide consent for the third party to accept the service and share the car data. Imagine driving into a shopping mall parking lot and being bombarded with requests from third parties to provide you with car cleaning services, driving by a Starbucks and receiving special coffee vouchers, or having random insurance companies offer you deals while cruising down the freeway. In all of these cases, the driver must individually navigate through and analyze each request, determine if it is genuine, and provide consent if they feel comfortable. Apart from the driver safety aspects of being interrupted with requests while driving around town, it is clear that BMW has not really thought through the user interface (UI)/user experience (UX) of this solution. For a leading auto OEM that potentially sees the value of a car moving from a product to an experience, this is a major oversight and, in my view, does not really instill confidence in BMW’s abilities to navigate the future.

Learning to Apply AI from the Ground Up

On the opposite end of the spectrum, the show’s presentations from Uber and Ridecell provided unique ideas of how new business models could emerge and, more importantly, best practices of how they are using data to enhance services. For example, Uber showed how it saw demand for Uber in London shift from Central London to train stations at the outskirts since the launch of the 24-hour Night Tube services earlier in 2017, and how it was able to shift resources and service customers to meet that demand. Both Uber and Ridecell are based in Silicon Valley and built from the ground up as digital businesses that are applying AI from the beginning. One of the biggest advantages they have is that they are part of the services stack, owning almost no physical infrastructure, which gives them a massive advantage over traditional auto OEMs that will most likely need to partner, rather than compete with them in this new mobility-as-a-service paradigm.

(Source: Tractica)

Throughout the TU-Automotive conference, across hallways and at lunch tables, it was very apparent that auto OEMs are worried about the scale and pace of disruption. They realize that their organizations are too institutional and hierarchical to implement changes at the rate at which some of the new digital players are innovating, which do not have to bother about legacy business models or supply chains.

Mobility and Service Experiences Will Drive the Future for Automotive Companies

For any successful AI company, it is paramount that they implement a successful data strategy, but as seen in the case of BMW, while it thinks it has a data strategy that complies with the upcoming General Data Protection Regulation (GDPR), it has created something that does not really work for the driver and the customer. It is very likely that auto OEMs will catch up to self-driving capabilities as the self-driving stack becomes commoditized, but they will face bigger issues in re-engineering their supply chains and dealerships to account for new ride sharing, carpooling, and autonomous services. The value in automotive will essentially center around the passenger experience, which will be driven by customer data, rather than car and telematics data. The auto OEMs cannot really compete with Google, Facebook, Amazon, or Apple when it comes to consumer and behavioral data. Google knows much more about my favorite coffee shop and clothes brand than my car company. While there is still value in the auto OEM brand, and you are likely to use a BMW-powered ride-sharing service, the value proposition is significantly watered down and hard to differentiate in a mobility- and service-driven future where customer touchpoints are transactional, rather than life long.

By Aditya Kaul

Research Director, Tractica