- The installed base of cloud-based home management services is projected to grow from 5.6 million at the end of 2013, to 44.6 million at the end of 2018.

- Cloud-based home management systems are aimed at mass market adoption, and allow users to remotely control their devices when away from the home, using smartphone or tablet apps and web portals. They cover a broad range of applications, such as energy management, HVAC control, home monitoring, lighting control, independent living services, and more.

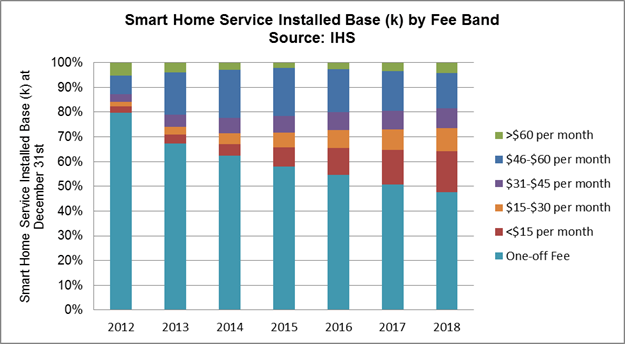

- A variety of pricing models exist for smart home services and while there is some consistency between those exhibited by different company types, this can vary by country or region, as well as by company type.

- Smart home specialists have accounted for the highest proportion of the market historically. This includes both home automation providers, such as Control4 or Savant Systems, to name a few, along with an emerging range of connected home specialists, such as Nest, Revolv or SmartThings. Smart home specialists typically include the service aspect as part of an upfront device or service purchase, although there are some exceptions.

- However, other company types – ranging from security providers to telecommunications companies, utility companies, security providers, retailers and device suppliers, are gaining market share in the smart home service market, each impacting the pricing models exhibited, as highlighted in the figure below.

- Security providers generally require ongoing monthly fees for smart home services, typically in conjunction with a professionally monitored security package. Multi-service operators (MSOs) entering the market have displayed a variety of models. In North America, almost all MSOs charge a monthly fee for ongoing smart home services; in contrast, in parts of Europe, some MSOs offer these services with an upfront cost only, for example Deutsche Telecom’s Smart Home package (using the Qivicon platform), whereas others follow the North American model. Similarly, utility companies have pursued both pricing models.

- Device suppliers starting to provide smart home services are expected predominantly to include the service as part of the upfront device cost, as a value-adding feature to help sell more compatible devices; however, as with other company types, some are projected to pursue the ‘free-mium’ model, offering a basic level of ongoing service as part of the initial cost, with the option to upgrade to additional functionality for a recurring charge.

- In terms of regional differences, smart home services in North America, which is at the forefront of the smart home market in terms of the installed base, are more likely to be monetized through ongoing charges, partly as a result of the high rate of ‘bundling’ with professionally monitored security services. In contrast, in Europe, upfront system charges are more common, without recurring service fees.

- A growing number of companies entering the smart home market are projected to offer favorable pricing for subscribers of pre-existing business lines without requiring such subscriptions as a pre-requisite. For example, Comcast in the US offers lower monthly fees for Xfinity triple-play customers and British Gas in the UK offers its Hive active heating system with a different pricing model for existing energy customers, but both services are also available to non-customers.

- In addition, the ‘free-mium’ model will become increasingly popular, particularly from companies currently offering up-front only pricing. Other ways of making money from the provision of smart home services will continue to evolve, ranging from data monetization through to user interface advertising or peripheral product ordering and e-commerce opportunities.

Information in this research note was taken from the “Smart Home Subscribers Intelligence Service”, which offers continuous tracking of the smart home market across 26 countries and sub-regions, segmented by service provider type, application, prerequisite service, pricing model, service price band and gateway type.

Regards,

Lisa Arrowsmith

Associate Director

Connectivity, Smart Homes & Smart Cities

IHS Technology

[email protected]

3-5 Huxley Close

Wellingborough

NN8 6AB

United Kingdom

www.ihs.com

Tel: +44 (1933) 402255

Fax: +44 (1933) 402266